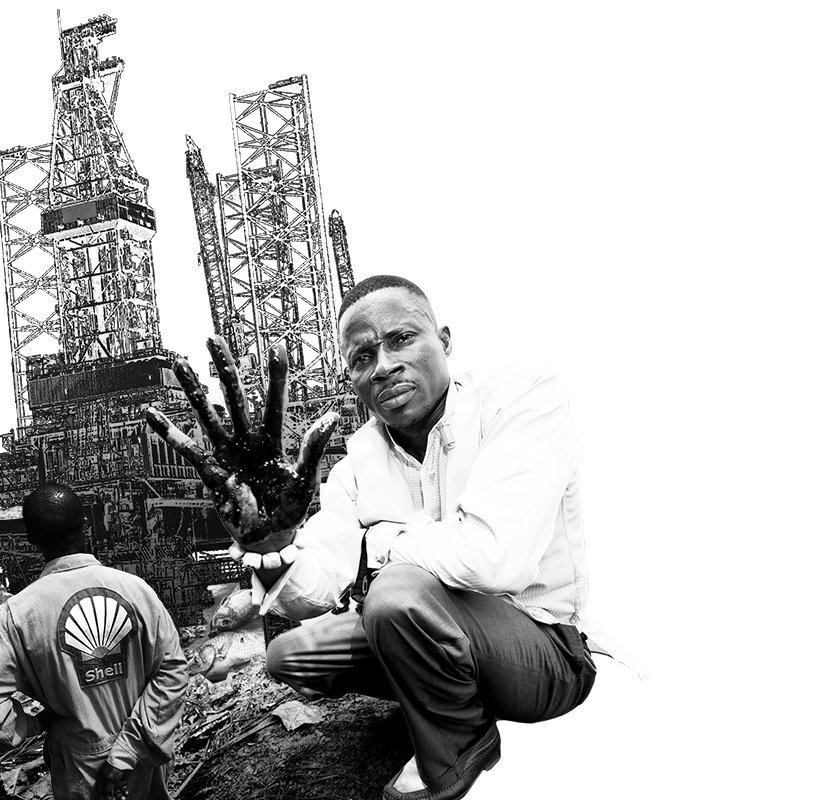

Big Oil bribes and bullies governments to sign flawed deals

Shell and Eni vs Nigeria

Fossil fuel giants Shell and Eni have used Nigeria’s investment treaty with the Netherlands to pressure the Nigerian government into allowing their polluting and profitable projects. Shell’s initial $1.8 billion investor-state dispute settlement (ISDS) claim helped the oil companies secure a lopsided license for one of the country’s richest oil fields in 2011. The deal deprived Nigeria of its share in future profits from the oil. In 2023, a later government succumbed to further pressure from a second ISDS lawsuit, dropping corruption claims against the oil majors. As a result, Nigerians could lose out on billions in oil tax revenue, as well as recovered assets.

“Perhaps the arbitration may kick in some actions,” a Shell manager wrote to colleagues in June 2008.[1] A year before, the oil giant had lodged an investor-state arbitration claim against Nigeria, arguing that the country had violated its investment treaty with the Netherlands.[2] Before that, the Nigerian government had re-allocated an oil field exploration license from Shell to a Nigerian company.

The deep-water field, known as OPL 245, is one of Africa’s most lucrative oil fields. Shell wanted the license back, and lodged ISDS proceedings to pressure the government. The oil company demanded $1.8 billion in compensation – nearly four times the $460 million it had invested in the field by then.[3]

“Filing an ISDS claim can… act as a trump card that companies can use to obtain more favorable conditions or exemptions for their investments. This makes ISDS a powerful weapon that internationally operating companies can add to their already extensive arsenal of lobbying instruments.”

Friends of the Earth Netherlands (Milieudefensie) and Centre for Research on Multinational Corporations (SOMO) comment on Shell’s ISDS suit against Nigeria [4]

The claim worked. In early 2008, a Nigerian official told Shell’s lawyer that “the arbitration causes embarrassment for the government”. In spring 2010, Nigeria indicated it was “keen to settle… avoiding an unfavourable outcome” of the arbitration.[5] Under the shadow of the ISDS case, the rights to OPL 245 were transferred to Shell and Eni in 2011. The companies paid $1.3 billion in return, and the ISDS case was dropped.[6]

Depriving Nigerians of billions

This deal has been heavily criticised as coming at the expense of the Nigerian people. The tax terms deprive the country of its share in profit oil – the oil that remains after costs have been covered. As a result, Nigeria is set to lose between $4.5 billion and $10.6 billion in revenue, when compared with standard contracts, depending on the price of oil.[7] At the time, that was equivalent to twice the country’s annual health and education budget, or enough to train six million teachers.[8] The Nigerian state’s ability to buy back its right to its own oil field has also been severely restricted by the deal.[9] Why did Nigeria accept such a flawed deal? The threat of a potential billion-dollar arbitration award certainly helped to pile on the pressure.

“These companies and Nigerian officials agreed a sweetheart deal that deprives Nigeria of money it badly needs to build schools and pay doctors.”

Olanrewaju Suraju, Nigerian anti-corruption activist and chairman of the Human and Environmental Development Agenda (HEDA)[10]

Moreover, a large chunk of Shell and Eni’s $1.3 billion payment did not go into the public purse. Instead, it ended up in the pockets of politicians and middlemen. Just three years later, in February 2014, the Nigerian House of Representatives called for the deal to be cancelled, describing it as “contrary to the laws of Nigeria.”[11]

Oil bribery saga

In an attempt to hold Eni and Shell accountable for the corrupt deal and recover the money paid as bribes, NGOs and subsequent Nigerian governments initiated investigations and legal proceedings in multiple countries. Yet, by 2023, many of these court cases had been dropped, or had cleared the oil majors of the corruption charges – sometimes to the horror of the international anti-corruption community.[12]

But there was some hope that the oil majors would be held to account. A compensation claim by the Nigerian government was still awaiting a final verdict in Italy’s Supreme Court.[13] Nigeria had sued Eni and Shell for $1.1 billion in damages – money lost due to the corruption involved in their 2011 purchase of the oil rights. Nigerian President Muhammadu Buhari, who was elected on an anti-corruption ticket, insisted that the oil field could not be developed before all bribery trials were concluded. Civil society urged him to stand firm.[14]

“Nigerians need answers… President Muhammadu Buhari should reject calls to stop litigation over a deal that may have caused the Nigerian public an enormous loss.”

Auwal Musa Rafsanjani, Executive Director of CISLAC, Transparency International’s Nigeria chapter[15]

ISDS bullying sees corruption claims dropped

But another successful legal bullying episode followed, this time by Eni. In 2020, the Italian oil major sued Nigeria in an ISDS tribunal,[16] accusing the state of “a multi-jurisdictional litigation campaign” against it. It also argued that Nigeria was “improperly conditioning” the conversion of the OPL 245 exploration license into an extraction license on the conclusion of the court cases, thereby “blocking production in the oilfield”. Without the new license, “the $2.5 billion in investments already made by Eni and Shell… will have been for nothing,” Eni wrote, hinting at another potentially expensive claim.[17]

Once again, the pressure from the arbitration apparently worked. In November 2023, Bloomberg reported that Nigeria, under its new President Bola Tinubu, would waive its claims in Italian courts – “unconditionally” and “with immediate effect”. The government even “irrevocably” waived its right to any future legal action against Eni and Shell relating to OPL 245. “We are pleased that this claim has been withdrawn,” a Shell spokesperson rejoiced.[18] Eni put its arbitration on hold.

Circumventing anti-corruption clauses

Remarkably, Eni chose not to sue under the investment treaty between Italy and Nigeria. Instead, the Italian corporation sued via its Dutch subsidiaries, using the more investor-friendly investment agreement between the Netherlands and Nigeria. The Italian treaty protects only investments that comply with the law of the host state, while the Netherlands-Nigeria treaty contains no such limitations or ʻlegality’ clause.[19]

Civil society groups protested Eni’s abuse of its Dutch subsidiaries, which had played no role in OPL 245, “to take advantage of the absence of legality clauses” in the Netherlands-Nigeria investment treaty. They also warned that investment arbitration should not become “a tool for resisting actions by host states seeking to hold the corrupt to account.”[20]

Negotiating under the shadow of ISDS

Since then, the parties have been negotiating over the conversion of the OPL 245 exploration license to a production license – knowing that Eni could resume the legal proceedings any time.

Nigeria’s withdrawal of its corruption claims was heavily criticised. “Nigeria needs income. But a decision to surrender to Shell and Eni… and abandoning the fight against corruption is not the way forward,” stated human rights and development group HEDA. It recalled that the 2011 deal denied the country any share of the profit oil from exploiting OPL 245. If the deal was left intact, Nigeria would not benefit from one of its richest oil fields.[21]

“Nigeria’s masses, none of whom have benefitted from the billions of dollars looted by Nigeria’s elite through oil developments, will again be the losers,” HEDA said.[22] ISDS shifts the balance of power further in favour of the few who line their pockets at the expense of the many.

[1] SOMO and Milieudefensie: Bend or break. How Shell used an international investment treaty to browbeat Nigeria into a lucrative deal on OPL 245 oil field, April 2019, p. 6.

[2] UNCTAD: Shell v. Nigeria (I) Shell Nigeria Ultra Deep Limited v. Federal Republic of Nigeria (I) (ICSID Case No. ARB/07/18). Documents from the case can be found on the OPL 245 documents website run by ReCommon et al.

[3] Ibid. and Shell Nigeria Ultra Deep Limited: Request for arbitration, 26 April 2007, p. 5.

[4] SOMO and Milieudefensie: Bend or break. How Shell used an international investment treaty to browbeat Nigeria into a lucrative deal on OPL 245 oil field, April 2019, p. 3.

[5] Ibid., p. 6.

[6] Ibid.

[7] Don Hubert: Government Revenues from OPL 245. Assessing the Impact of Different Fiscal Terms, November 2018, p. iii.

[8] Global Witness: Take the future: Shell’s scandalous deal for Nigeria’s Oil, 26 November 2018.

[9] Global Witness: New analysis shows Shell and Eni used Nigeria’s share of oil to fund alleged billion dollar bribery scheme, 25 April 2019.

[10] Ibid.

[11] Global Witness: Shell’s Nigeria investments at risk from corruption scandal, investors warned, 19 May 2014.

[12] In 2021 and 2022, Italian courts acquitted Eni and Shell of the corruption charges linked to OPL 245. The OECD Working Group on Bribery criticised the acquittal as not conforming to the OECD Anti-Bribery Convention, and expressed concern over the court’s rejection of evidence. See: HEDA, Re:Common and The Corner House: Italy Slammed in Alleged International Bribery Case, 20 October 2022. See also: HEDA, Re:Common and The Corner House: Commentary on Milan OPL 245 Judgment The Judges’ “alternative explanations”, July 2022.

[13] Sahara Reporters: OPL 245: Nigeria Appeals Dismissal Of $1.1Billion Compensation Request Against Eni, Shell, 30 May 2023.

[14] Global Witness: Shell and Eni lose rights to scandal plagued Nigerian oil licence as corruption trials continue, 26 May 2021.

[15] Transparency International: Nigeria oil bribery case: Netherlands and US must reopen investigations into Eni and Shell’s role, 22 May 2023.

[16] For the procedural details, see: ICSID: Eni International B.V., Eni Oil Holdings B.V. and Nigerian Agip Exploration Limited v. Federal Republic of Nigeria (ICSID Case No. ARB/20/41).

[17] Eni: Memorandum in support of ex parte application of Eni S.P.A. for an order pursuant to 28 U.S.C. 1782 granting leave to obtain discovery for use in foreign proceedings, 6 October 2020, pp. 2 and 12; Eni: Eni files an appeal for international arbitration against Nigeria.

[18] Alberto Brambilla and William Clowes: Nigeria withdraws $1 billion claim against Eni on oil field deal, Bloomberg, 16 November 2023; Laura Hurst: Nigeria withdraws legal claim against Shell over oil field deal, Bloomberg, 17 November 2023.

[19] Global Witness, HEDA et al.: Letter to David Malpass. ICSID: Concerns over (1) lack of clear regulations governing cases involving corruption; and (2) the adjudication of cases where underlying Bilateral Investment Treaties (BITS) do not require compliance with host country law, 13 November 2020.

[20] Ibid.

[21] Sahara Reporters: OPL 245: Tinubu’s Move To Grant Shell, Eni Companies Licence Which Buhari Rejected Over Corruption Will Throw Nigeria Into Colossal Loss – HEDA Warns, 31 January 2024.

[22] Ibid.