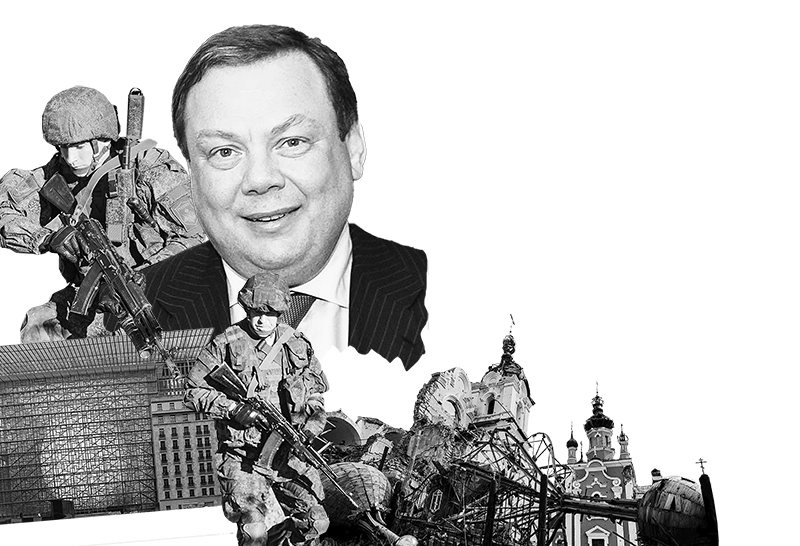

The Russian oligarch suing over sanctions

Fridman vs Luxembourg

A Russian oligarch is subject to EU sanctions over the Russian invasion of Ukraine. He is using ISDS to sue Luxembourg, which has frozen his assets – and demanding a gigantic $16 billion payout. The case shows how ISDS can be used to challenge government decisions about issues as fundamental as war and peace, and undermine the EU’s response to the attack on Ukraine. Of course this approach can only be used by the ultrawealthy, not by ordinary victims of war and aggression.

One of the original oligarchs

Mikhail Fridman is a Russian oligarch – one of the originals. He was one of the ‘Seven Bankers’ said to control around half the Russian economy in the mid-1990s, and to be bankrolling then Russian president Yeltsin. He is still in the top ten Russian billionaires on Forbes’ 2025 Richest List, thirty years later.[1] Fridman has a reputation as a ruthless wheeler-dealer who has been able to keep his balance at the top through many political and economic upheavals.

Fridman amassed his fortune during the Yeltsin years, when the former Soviet Union’s assets were sold off to people with connections. He built up Alfa Group – a conglomerate with interests in everything from commodities to retail to insurance. He teamed up with a former government minister, Petr Aven, and together founded Alfa Bank, which became Russia’s largest private bank. He also bought a state-owned oil company in Siberia and formed a joint venture with BP, eventually selling out to Rosneft.

In the late 2000s Fridman restructured his business empire so that a considerable portion of it fell under a holding company[2] in Luxembourg, a favourite corporate destination. In the 2010s he founded an investment company, LetterOne, also headquartered in Luxembourg.

Sanctioned by the EU

The EU introduced a sanctions regime against Russia following the Russian annexation of Crimea in 2014, including sanctions against individuals. When Russia invaded Ukraine in February 2022, the EU extended the sanctions and within days Fridman, along with Aven, was added to the list.[3]

“Aven, Fridman, and other key Alfa Bank oligarchs are indeed close cronies and insiders of Putin’s regime, and do not operate independently of Putin’s demands.”

– Open letter by anti-corruption activists and political analysts[4]

The sanctions for individuals involve seizure of assets and a travel ban. As of 2025, 2,400 people were on the sanctions list, which is compiled by the EU based on information from member states, and signed off by the European Council.[5] People can be added to the list for a range of reasons, including supporting Russia’s actions against Ukraine, or being a businessperson who provides a “substantial source of revenue” to the Russian government.[6] Both of these reasons apply to Fridman and Aven.

The sanctions list is currently reviewed twice a year, and signed off again by the Council, meaning that a new version of the list is created every six months.

Fridman and Aven challenged their inclusion on the list in the European courts. The court ruled that the initial evidence cited by the EU in the version of the list under which they were first included was not sufficient to prove they supported Russian action against Ukraine.[7] Latvia is appealing the court’s decision.[8]

However both men remain on later versions, on the separate grounds of being business people who provide substantial revenue to the Russian government.[9]

In subsequent lists the EU has also provided further evidence of Fridman’s links to the Russian military.[10] An insurance company within Alfa Group insures vehicles of some military units, and the presidential bodyguard. It also insures two Russian weapons companies. Also, the retail arm of Alfa Group has a joint venture with a Ministry of Defence owned company to run shops on military bases.[11]

More recently, Fridman and Aven offloaded their shares in Alfa Bank and the insurance company, as part of their attempts to avoid sanctions.[12] However those were assets that should have already been frozen, and they were only able to get around this with the cooperation of the Russian government. This in itself demonstrates their close ties to the regime and is now also included as evidence.[13]

War and profit

In 2024, Fridman sued the Luxembourg government using ISDS under the Belgium/Luxembourg – Russia Bilateral Investment Treaty (BIT). This is the first known ISDS case against Luxembourg.

In compliance with the EU-agreed sanctions Luxembourg froze Fridman’s assets in the country. This includes the holding company for Alfa Bank and much of the rest of his business empire, as well as Letter One.

Fridman is demanding $16 billion (€14 billion) in compensation. This is a preposterously large amount – equivalent to half Luxembourg’s entire central government revenue.[14] It is also only slightly more than Forbes estimates Fridman is worth in total ($14.9 billion in 2025).[15] So effectively the Russian oligarch is saying he is broke, and asking the taxpayers of Luxembourg to pay him his entire fortune back!

“There is a wide range of investors that can bring investment treaty claims in response to […] EU sanctions.”

– Javier Garcia Olmedo, Professor from the University of Luxembourg[16]

The case is being hosted in the Hong Kong International Arbitration Centre, which does not make information on its cases public. However specialist media reports provide more details.[17]

Fridman calls the EU sanctions regime a ‘witch-hunt’ against Russian business people and argues that freezing his assets is expropriation. This directly questions the authority of a country’s government to implement military and security policy at a time of war.

ISDS cases routinely challenge the ‘right to regulate’ of governments – fundamentally, ISDS is a tool to ensure that nothing gets in the way of business as usual. However, it is more common for claims to critique government action on, for example, environmental measures, public services or mining permits.

But in this case, ISDS is being used to challenge decisions of countries on the fundamental issue of war and peace – seeking to undermine the EU’s ability to take economic measures in response to a war of aggression. If the case succeeds it could open the door to challenges from others who are subject to sanctions by the EU and elsewhere (there have already been rumours of an ISDS case over UK sanctions),[18] and the amounts involved could stack up. Meanwhile, those who have lost their livelihoods in the war do not have VIP access to a parallel legal system that could provide compensation to them.

Supermarket-style price match promises for ISDS?

The particular ISDS treaty Fridman is using in this case is actually quite restrictive, and probably wasn’t intended to be used for this type of dispute. The oligarch disagrees of course. But he also argues that even if this usage wasn’t originally intended, it doesn’t matter because the treaty has what is called a ‘most-favoured nation’ or MFN clause.

This is akin to a supermarket price match promise: it says if you can get a better offer in another treaty from the same country it can be matched in this one. Thus as Luxembourg has signed investment treaties with other countries that would allow for this type of case, Fridman argues that this provision should be matched in the treaty with Russia.

This case thus has very worrying implications for ongoing attempts to reform ISDS treaties by limiting their worst excesses, instead of getting rid of the treaties altogether. It would mean that a reform could be unravelled simply by an investor pointing out a more extreme provision in an unreformed treaty, and demanding that this provision be matched.

[1] “Seven Bankers”, Wikipedia. “World’s billionaires list: the richest in 2025” Forbes, 2025.

[2] ABH Holdings.

[3] European Union, Council Implementing Regulation (EU) 2022/336 of 28 February 2022 implementing Regulation (EU) No 269/2014 concerning restrictive measures in respect of actions undermining or threatening the territorial integrity, sovereignty and independence of Ukraine. EUR-Lex.

[4] “Oligarchs from Alfa Group Should be Asked Critical Questions at the Atlantic Council Dinner” New Atlanticist Blog, 21 May 2018.

[5] European Council, EU sanctions against Russia. European Union, Consolidated text: Council Regulation (EU) No 269/2014 of 17 March 2014 concerning restrictive measures in respect of actions undermining or threatening the territorial integrity, sovereignty and independence of Ukraine. EUR-Lex.

[6] European Union, Council Regulation (EU) No 269/2014 of 17 March 2014 concerning restrictive measures in respect of actions undermining or threatening the territorial integrity, sovereignty and independence of Ukraine. Article 3, EUR-Lex.

[7] Court of Justice of the European Union, “War in Ukraine: the General Court annuls the inclusion of Petr Aven and Mikhail Fridman on the lists of persons subject to restrictive measures between February 2022 and March 2023” Press release no 61/24, 10 April 2024.

[8] “Latvia appeals removal of sanctions on Russians Fridman and Aven” Reuters, 24 July 2024.

[9] Max Seddon and Laura Dubois, “Russian billionaires Fridman and Aven sell Alfa-Bank stakes in bid to overturn sanctions” Financial Times, 6 February 2025. European Union, Council Implementing Regulation (EU) 2025/527 of 14 March 2025 implementing Regulation (EU) No 269/2014 concerning restrictive measures in respect of actions undermining or threatening the territorial integrity, sovereignty and independence of Ukraine. EUR-Lex.

[10] Council Implementing Regulation (EU) 2025/527 of 14 March 2025.

[11] Council Implementing Regulation (EU) 2025/527 of 14 March 2025. “X5 and Voentorg launch joint project” Oreanda News, 27 August 2014.

[12] Max Seddon and Laura Dubois, “Russian billionaires Fridman and Aven sell Alfa-Bank stakes in bid to overturn sanctions” Financial Times, 6 February 2025.

[13] Council Implementing Regulation (EU) 2025/527 of 14 March 2025.

[14] Luxembourg’s central government revenue is anticipated to be €29.6billion in 2025, and was €25.7billion in 2023 (the most recent year for which statistics were available at the time of writing).

[15] “Mikhail Fridman” Forbes, 2025.

[16] Javier Garcia Olmedo, “The Legality of EU Sanctions under International Investment Agreements”

European Foreign Affairs Review, 2023.

[17] Lisa Bohmer, “Russian businessman lodges first known treaty arbitration against Luxembourg, alleging that EU sanctions amount to “witch-hunt” against wealthy Russian individuals and asking for upwards of 16 billion USD in damages” Investment Arbitration Reporter, 20 May 2024.

[18] Lisa Bohmer, “UK says they don’t have to disclose pending investor-state arbitrations, amidst rumors of treaty claim by Russian oligarch” Investment Arbitration Reporter, 27 March 2025.